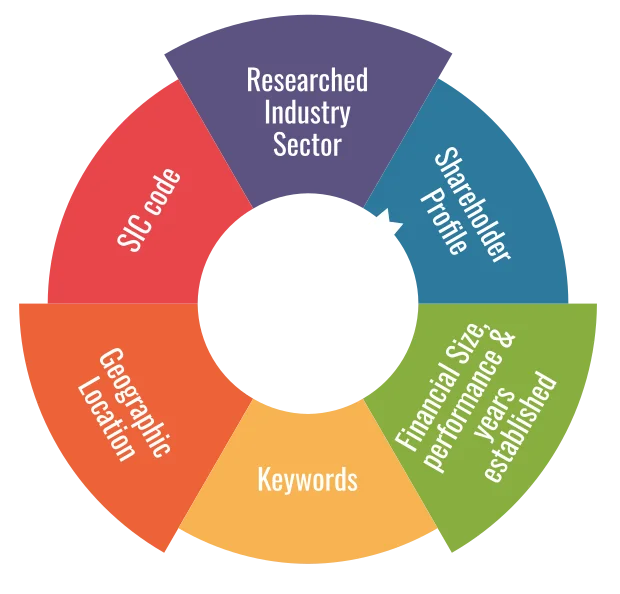

Business segmentation plays a crucial role in tailoring marketing strategies, identifying target markets, and optimising resource allocation. However, the sheer volume of available data can overwhelm businesses, making it challenging to extract actionable insights efficiently. In this context, leveraging industry-leading firmographic data selections, encompassing SIC codes, researched listings, financial parameters, geographic parameters, keywords, and shareholder profile parameters, emerges as a strategic approach to transform vast datasets into useful business information swiftly and accurately. This article explores the advantages of utilising comprehensive firmographic data selections to streamline the segmentation process and enhance decision-making.

SIC Codes for a rough sorting:

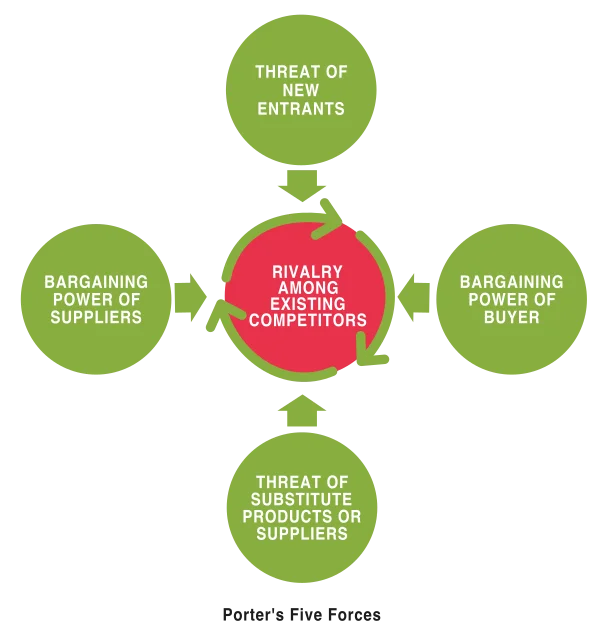

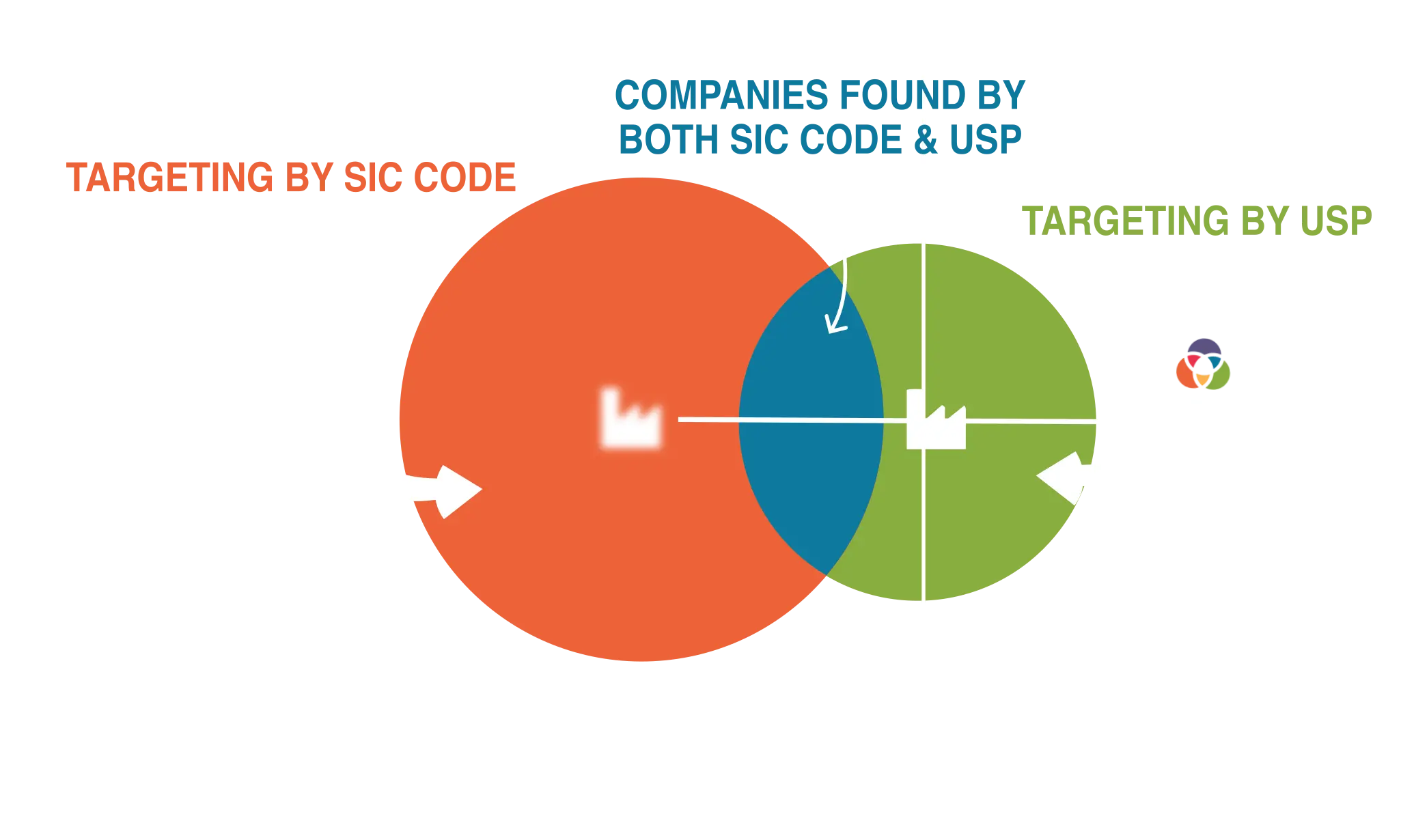

Standard Industrial Classification (SIC) codes provide a standardised framework for categorising industries based on their primary activities. By leveraging SIC codes, businesses can accurately classify organisations according to their industry affiliations, enabling precise segmentation and targeting. SIC codes offer a reliable foundation for understanding industry dynamics, market trends, and competitive landscapes, thereby enhancing the accuracy of business segmentation efforts. Moreover, SIC codes facilitate benchmarking and comparative analysis, enabling businesses to identify industry leaders, emerging players, and niche segments effectively.

Granular Insights from Researched Listings:

In addition to SIC codes, researched industry sector listings offer granular insights into niche markets, emerging industries, and specialised segments. Unlike static classification systems, researched listings adapt to evolving market trends and consumer preferences, providing businesses with up-to-date information for segmentation purposes. By incorporating researched listings into their segmentation strategies, businesses can uncover hidden opportunities, identify market gaps, and tailor their offerings to meet specific customer needs. This granular approach enhances the accuracy of segmentation by capturing nuances within industries and enabling targeted marketing campaigns.

Financial Parameters for Strategic Analysis:

Financial parameters, such as revenue, profitability, and growth rates, serve as critical indicators of organisational performance and potential. By integrating financial data into the segmentation process, businesses can prioritise high-value prospects, identify growth opportunities, and allocate resources effectively. Financial parameters enable businesses to segment organisations based on their financial health, investment potential, and strategic fit, thereby maximising the ROI of marketing initiatives. Moreover, financial analysis facilitates risk assessment and mitigation, allowing businesses to mitigate exposure to financially unstable or high-risk prospects.

Geographic Parameters for Localised Targeting:

Geographic parameters play a pivotal role in segmenting markets based on regional preferences, demographics, and socio-economic factors. By incorporating geographic data into the segmentation process, businesses can tailor their marketing strategies to local markets, optimise distribution channels, and capitalise on regional opportunities. Geographic segmentation enables businesses to target specific locations, cities, or regions where demand is high or competition is low, enhancing the effectiveness of marketing campaigns and driving customer engagement. Moreover, geographic parameters facilitate market expansion strategies, enabling businesses to identify new territories for growth and expansion.

Keywords for Contextual Relevance:

Keywords offer valuable insights into customer preferences, interests, and intent, enabling businesses to segment audiences based on their online behaviour and search patterns. By analysing keyword data, businesses can identify relevant topics, trends, and conversations within their target market, informing content creation, advertising strategies, and messaging. Keyword segmentation enables businesses to align their offerings with customer needs and preferences, enhancing the relevance and effectiveness of marketing communications. Moreover, keyword analysis provides valuable competitive intelligence, allowing businesses to identify emerging trends, monitor competitor activities, and differentiate their brand effectively.

Shareholder Profile Parameters for Strategic Partnerships:

Shareholder profile parameters, such as ownership structure, investor demographics, and institutional holdings, offer insights into corporate governance, ownership dynamics, and strategic alliances. By analysing shareholder data, businesses can identify potential partners, investors, or acquisition targets that align with their strategic objectives and growth aspirations. Shareholder segmentation enables businesses to prioritise outreach efforts, establish meaningful relationships, and unlock synergies through strategic partnerships. Moreover, shareholder analysis facilitates investor relations, corporate communications, and stakeholder engagement, enhancing transparency and trustworthiness.

In conclusion, leveraging industry-leading firmographic data selections is paramount for efficient and accurate business segmentation. By incorporating SIC codes, researched listings, financial parameters, geographic parameters, keywords, and shareholder profile parameters into the segmentation process, businesses can transform vast datasets into actionable insights quickly and accurately. This comprehensive approach enables businesses to identify high-value prospects, uncover market opportunities, and optimise marketing strategies for maximum impact. Moreover, leveraging firmographic data selections facilitates strategic decision-making, enhances competitiveness, and drives sustainable growth in an increasingly complex business landscape. By sorting the wheat from the chaff with better firmographic data, businesses can unlock new possibilities and stay ahead of the competition.

Latest articles

Enhancing Acquisition Success through Effective Business Segmentation

In the dynamic landscape of mergers and acquisitions (M&A), the process of business segmentation emerges as a critical component for identifying and evaluating potential targets. Business segmentation within the context of acquisitions involves the strategic categorization of target companies based on various criteria such as financial performance, geographic presence, industry sector, and shareholder profile. This…

Continue reading...Maximizing Business-to-Business Market Segmentation with Comprehensive Data

Understanding your target market is crucial for success in today’s ever-changing business environment. For B2B companies, effective market segmentation serves as the cornerstone of strategic decision-making and customer engagement. However, achieving precision targeting requires more than just surface-level insights. It demands leveraging comprehensive data, including researched industry sector reports, to optimize Business to Business market…

Continue reading...Enhancing Accuracy in Target Market and Market Segmentation: The Superiority of Researched Industry Sector Listings Over SIC Code Classifications

While Standard Industrial Classification (SIC) codes have traditionally served as a basis for industry classification, their limitations in accuracy, especially in a dynamic business environment, have become increasingly apparent. This article delves into the advantages of researched industry sector listings over SIC code classifications, with a focus on improving accuracy in classification. It examines how…

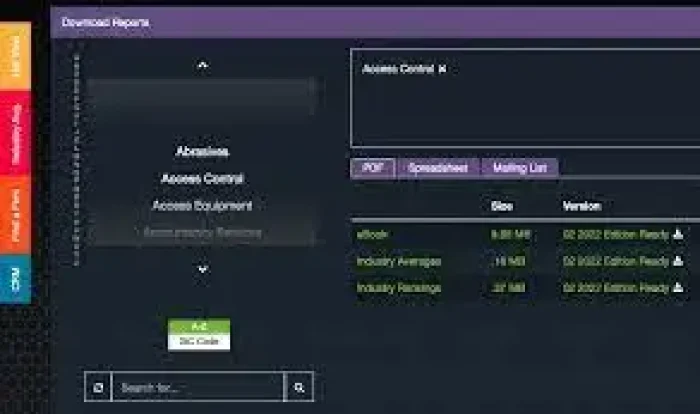

Continue reading...Find Company Information quickly with the USP Data App

Accelerating Deal Origination Deal Origination is made easier with the USP Data app. Because the universe of live UK companies is large we have included industry leading firmographic data selection tools to help you sift this mass of data to find company information you can rely on. The idea is that you can quickly screen…

Continue reading...Unveiling the Power of Niche Market Identification for Business Success

In a competitive SME business landscape, understanding and identifying relevant market niches is key. Of the 5 million plus limited companies live at Companies House there are probably only 1.7 million or so that are not dormant, intermediate holding companies or property management firms. This is still a considerable number to trawl through when attempting…

Continue reading...Converting your research to useful analysis

Just as a carpenter needs a saw in the toolbox to be taken seriously, anyone researching UK companies needs a tool like USP Data. Access to the latest information in an intuitive format is a pre-requisite if progress from research to analysis is to be swift. The definitive analysis of the list of suitable companies…

Continue reading...Shareholder Screening Guide

Shareholder profile can now be used as an additional screening criteria directly. SO the usual financial, geographic and sector seclections become subject to the selected shareholder profile such as age, and percentage of the shares. Using the templates you can extract the mailing addresses for the main shareholders for the shortlist of companies of interest…

Continue reading...Crm Upgrade Guide

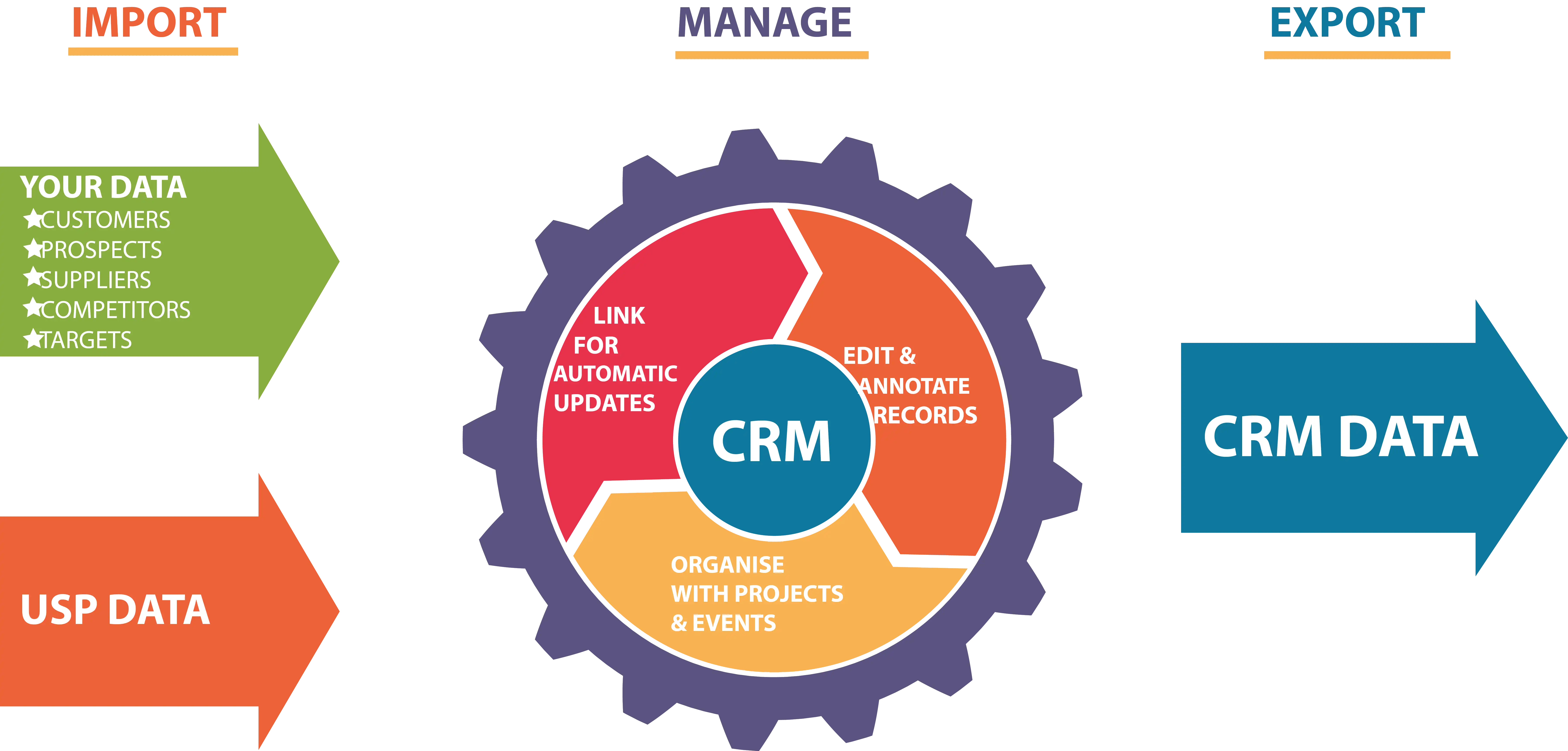

The CRM has received a significant upgrade in the latest edition of USP Data. The CRM remains the best place to save your work. CRM projects can be viewed directly on the list view and exported or pushed through one of the new templates you are able to define. A big change is the manner…

Continue reading...Data Templates Guide

Templates are a new addition to USP Data. The idea is that any data displayed in the List View can be viewed or exported using a template which you can define to exactly suit your purposes: You can select the exact data of interest from USP Data You can order the columns in the template…

Continue reading...Find Firm Improvements Guide

The Find a Firm side tab which provides access to the latest information on all the live companies at Companies House has been improved by: Allowing the search returns to run to 10,000 records rather than just 300 Listing the SIC code report as well as the researched report in which each company is listed…

Continue reading...High Quality Keyword Search

Using keywords can be a great to identify the companies likely to be of interest. Of course the quality of the data being searched needs to be high and even then care needs to be taken if keyword searches are to result in useful suggestions. The latest update to USP focuses on adding powerful options…

Continue reading...How to make Due Diligence easy

Assessment of business plans, corporate acquisitions or disposals and refinancing will all require due diligence investigations to confirm the facts being represented in the matter under consideration. This will require a tool or series of tools which allow an independent audit of the information being presented so that it may be confirmed in both hard…

Continue reading...Lead Building – sifting the wheat from the chaff

The sales funnel is a familiar concept which tracks the conversion of new contacts from suspects to leads to prospects and then to customers. This is typically represented as a cone with lots of leads being fed into the top of the cone and a much smaller number of customers resulting at the bottom. The…

Continue reading...Unlocking the opportunities hidden in abbreviated accounts

As you know Company Law allows “Small Companies” an option of disclosing less information at Companies House. This means that there is imperfect information in the public domain for SME firms. Companies House is the only verifiable source of financial data on privately held companies. As a result most of the attention is on the…

Continue reading...Valuing Companies Guide

Valuation is a tricky business! In a world of perfect information all risks are known, alternatives can be compared with certainty and cashflows can be discounted to provide the value of a firm. AI could be used to accurately land on a valuation which accounted for all the factors. It is clear that such perfect…

Continue reading...