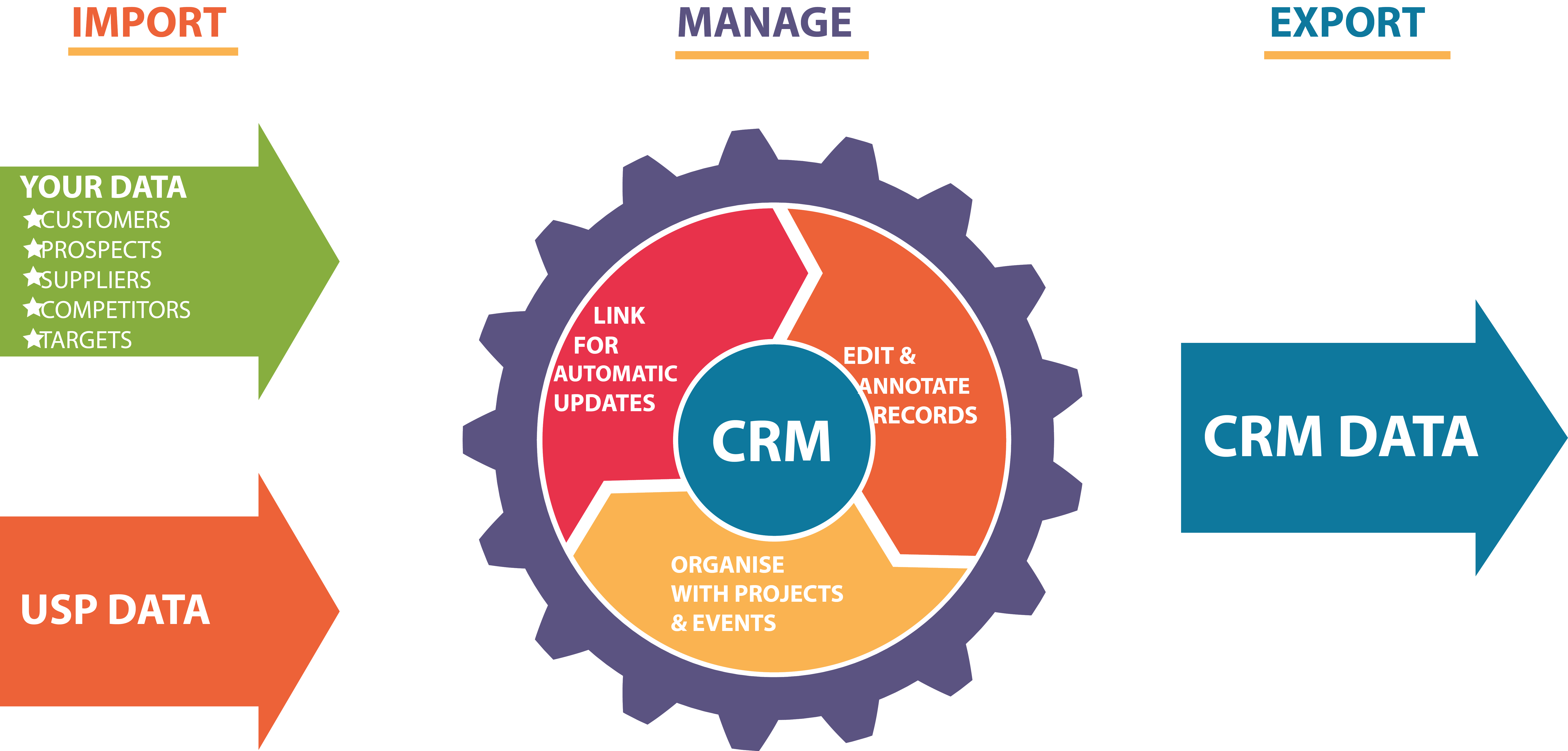

The CRM has received a significant upgrade in the latest edition of USP Data. The CRM remains the best place to save your work. CRM projects can be viewed directly on the list view and exported or pushed through one of the new templates you are able to define.

A big change is the manner in which you can add contact data to records in a project ie you can review the company director listing and select the contact to be added. Shareholdings, age and number of other directorship details can be used to make this decision. Also new is the facility to add CRM contacts directly into the CRM project of your choice from the find a firm area.

Notes you might make concerning each contact and programmed events you define can be addded to any CRM contact and saved directly into either your GOOGLE or OUTLOOK calendars. This allows better management of your contacts through the sales funnel.

These improvements are shown in the video below:

Contact us now to find out how USP Data can help with your data requirements

Latest articles

Enhancing Acquisition Success through Effective Business Segmentation

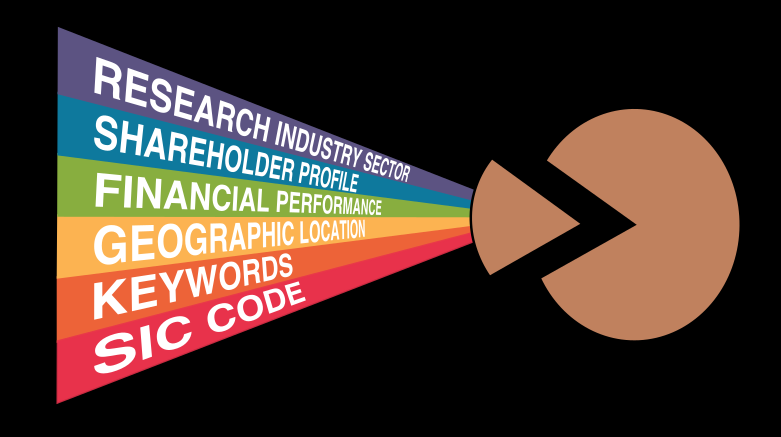

In the dynamic landscape of mergers and acquisitions (M&A), the process of business segmentation emerges as a critical component for identifying and evaluating potential targets. Business segmentation within the context of acquisitions involves the strategic categorization of target companies based on various criteria such as financial performance, geographic presence, industry sector, and shareholder profile. This…

Continue reading...Maximizing Business-to-Business Market Segmentation with Comprehensive Data

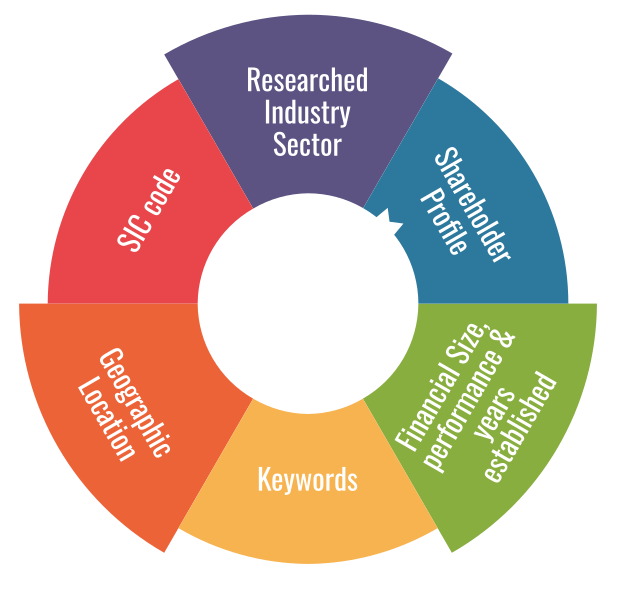

Understanding your target market is crucial for success in today’s ever-changing business environment. For B2B companies, effective market segmentation serves as the cornerstone of strategic decision-making and customer engagement. However, achieving precision targeting requires more than just surface-level insights. It demands leveraging comprehensive data, including researched industry sector reports, to optimize Business to Business market…

Continue reading...Leveraging Industry-Leading Firmographic Data Selections for Efficient Business Segmentation

Business segmentation plays a crucial role in tailoring marketing strategies, identifying target markets, and optimising resource allocation. However, the sheer volume of available data can overwhelm businesses, making it challenging to extract actionable insights efficiently. In this context, leveraging industry-leading firmographic data selections, encompassing SIC codes, researched listings, financial parameters, geographic parameters, keywords, and shareholder…

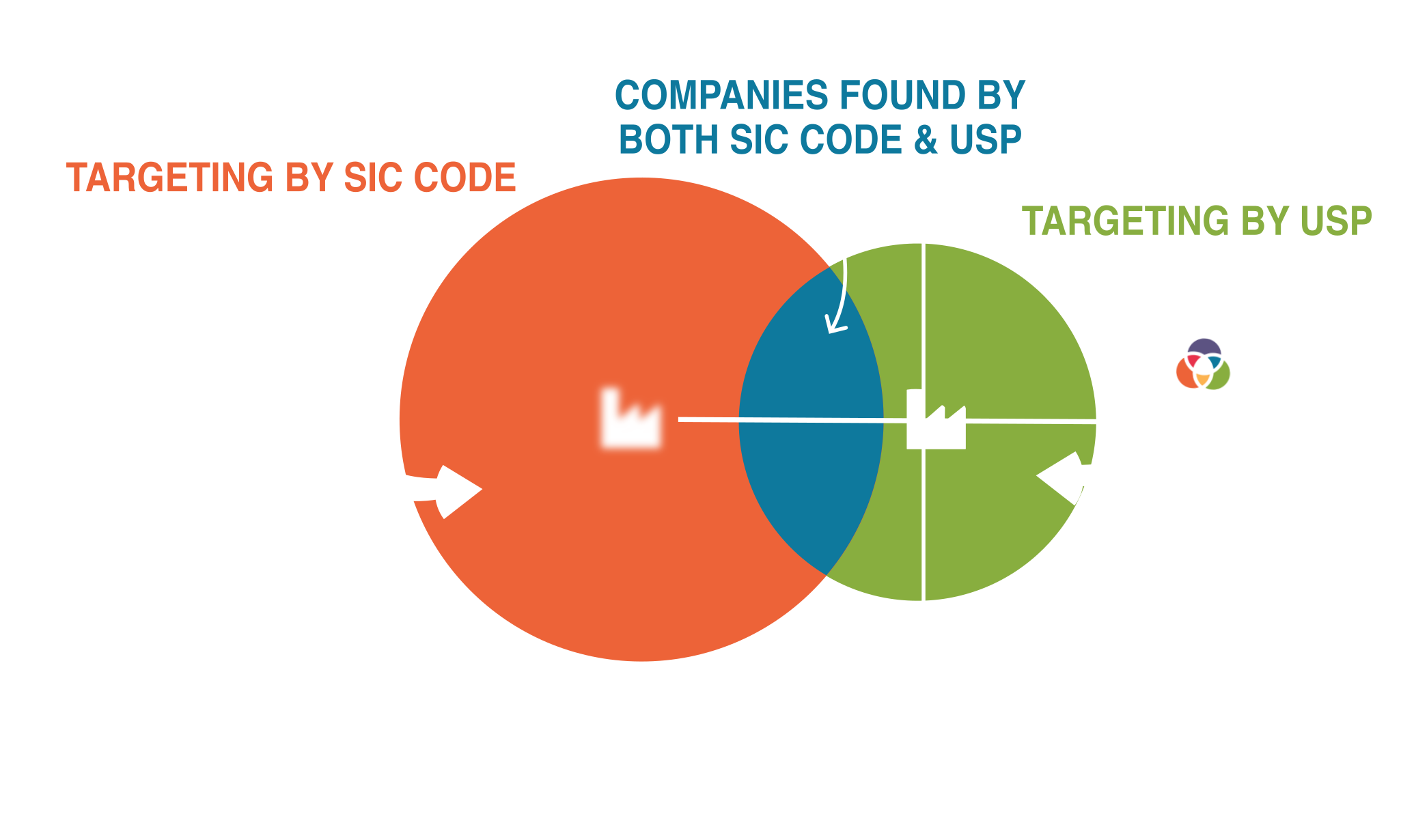

Continue reading...Enhancing Accuracy in Target Market and Market Segmentation: The Superiority of Researched Industry Sector Listings Over SIC Code Classifications

While Standard Industrial Classification (SIC) codes have traditionally served as a basis for industry classification, their limitations in accuracy, especially in a dynamic business environment, have become increasingly apparent. This article delves into the advantages of researched industry sector listings over SIC code classifications, with a focus on improving accuracy in classification. It examines how…

Continue reading...Find Company Information quickly with the USP Data App

Accelerating Deal Origination Deal Origination is made easier with the USP Data app. Because the universe of live UK companies is large we have included industry leading firmographic data selection tools to help you sift this mass of data to find company information you can rely on. The idea is that you can quickly screen…

Continue reading...Unveiling the Power of Niche Market Identification for Business Success

In a competitive SME business landscape, understanding and identifying relevant market niches is key. Of the 5 million plus limited companies live at Companies House there are probably only 1.7 million or so that are not dormant, intermediate holding companies or property management firms. This is still a considerable number to trawl through when attempting…

Continue reading...Converting your research to useful analysis

Just as a carpenter needs a saw in the toolbox to be taken seriously, anyone researching UK companies needs a tool like USP Data. Access to the latest information in an intuitive format is a pre-requisite if progress from research to analysis is to be swift. The definitive analysis of the list of suitable companies…

Continue reading...Shareholder Screening Guide

Shareholder profile can now be used as an additional screening criteria directly. SO the usual financial, geographic and sector seclections become subject to the selected shareholder profile such as age, and percentage of the shares. Using the templates you can extract the mailing addresses for the main shareholders for the shortlist of companies of interest…

Continue reading...Data Templates Guide

Templates are a new addition to USP Data. The idea is that any data displayed in the List View can be viewed or exported using a template which you can define to exactly suit your purposes: You can select the exact data of interest from USP Data You can order the columns in the template…

Continue reading...Find Firm Improvements Guide

The Find a Firm side tab which provides access to the latest information on all the live companies at Companies House has been improved by: Allowing the search returns to run to 10,000 records rather than just 300 Listing the SIC code report as well as the researched report in which each company is listed…

Continue reading...High Quality Keyword Search

Using keywords can be a great to identify the companies likely to be of interest. Of course the quality of the data being searched needs to be high and even then care needs to be taken if keyword searches are to result in useful suggestions. The latest update to USP focuses on adding powerful options…

Continue reading...How to make Due Diligence easy

Assessment of business plans, corporate acquisitions or disposals and refinancing will all require due diligence investigations to confirm the facts being represented in the matter under consideration. This will require a tool or series of tools which allow an independent audit of the information being presented so that it may be confirmed in both hard…

Continue reading...Lead Building – sifting the wheat from the chaff

The sales funnel is a familiar concept which tracks the conversion of new contacts from suspects to leads to prospects and then to customers. This is typically represented as a cone with lots of leads being fed into the top of the cone and a much smaller number of customers resulting at the bottom. The…

Continue reading...Unlocking the opportunities hidden in abbreviated accounts

As you know Company Law allows “Small Companies” an option of disclosing less information at Companies House. This means that there is imperfect information in the public domain for SME firms. Companies House is the only verifiable source of financial data on privately held companies. As a result most of the attention is on the…

Continue reading...Valuing Companies Guide

Valuation is a tricky business! In a world of perfect information all risks are known, alternatives can be compared with certainty and cashflows can be discounted to provide the value of a firm. AI could be used to accurately land on a valuation which accounted for all the factors. It is clear that such perfect…

Continue reading...